These days, barely a minute goes by without a consultant somewhere in the world publishing an article about why Industry X needs to “get digital or get gone”, or about how companies in this or that sector are leaving huge reserves of potential untapped by not applying new, digital ways of working or building new digital business models. And you know what? They’re all right.

Why, though, do I feel compelled to add another article to the pile about the importance to a specific industry of getting serious about digital? Primarily because I work closely with a lot of investment funds and family offices and can confidently state that this is a message, which many in private equity still need to hear. Fashion retail execs, board members of big banks, car bosses: all of these groups have, some more belatedly than others, become aware of the challenges and opportunities of digital in their industries – and taken sometimes more, sometimes less convincing measures in response. When it comes to investment funds and family offices, however, the picture is a little different: let’s just say that not all of them are exactly at the vanguard of the digital transformation…

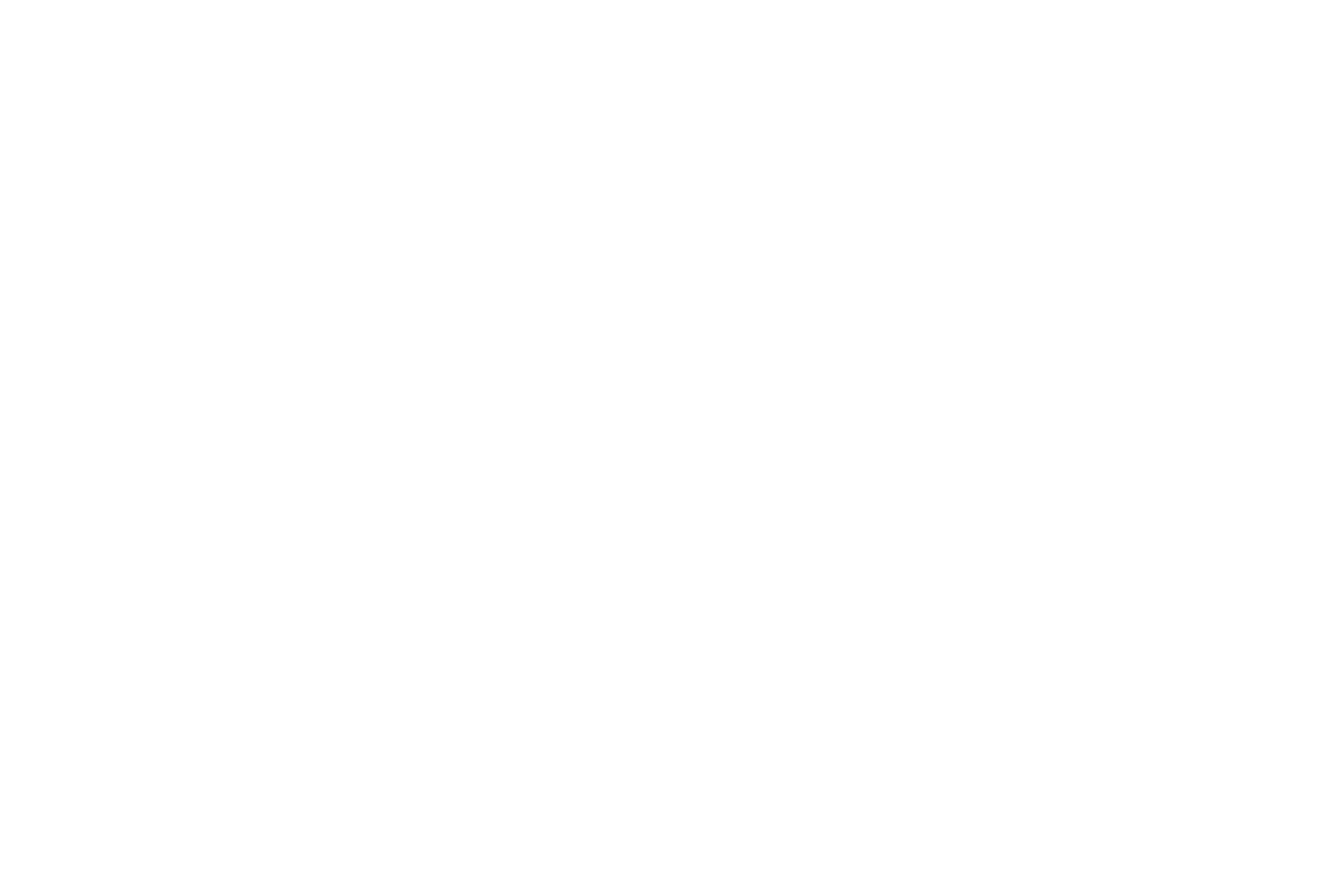

That’s not to say that the funds and offices I work with are doing a bad job. Quite to the contrary, some of the smartest people you will ever meet with an almost supernatural feel for specific markets are in their employ. You have your accounting cracks, who can crunch the numbers on valuations and do due diligences that will really make you think; then there are the banking buffs with their knowledge of sales, trades, and deals, as well as those indispensable people highly-skilled in the art of dealing with institutional investors and corporates. In contrast to what has happened in many other areas, none of this knowledge has been rendered worthless by digital; in fact, some of it is more important than ever. Yet is has been rendered incomplete, and so unless people with classic investment skill-sets broaden their knowledge to take account of the effect the digital transformation is having on the economy and on business – and unless investment funds and family offices succeed in attracting new profiles with in-depth digital expertise – they risk falling behind those who do.

Diminishing marginal returns? It’s time to get digital.

Fundamentally, there are two drivers behind the increasing importance of digital in investment. On the one hand, the benefits to be had from classic activities such as financial engineering and multiple arbitrage are tapering off; also, now that most companies have already been through several rounds of conventional optimisation, the remaining potential to be squeezed out of portfolios is dwindling. In other words, in a marketplace in which the wizardry and voodoo of yesteryear have become the go-to remedies and standard operating procedures of today, it follows that a genuine competitive edge will have to come from somewhere else. Hence, on the other hand, the second driver behind digital: it offers significant potential to increase value across the board.

What do we mean by ‘digital’, though, especially in the context of investment funds and family offices? To avoid being too woolly – and to make sure this isn’t just another “Digital or die!” article – let me break that down.

A useful way to think about how digital competencies can offer a competitive advantage in an investment environment is to look at how they can be applied to the three key stages of the investment cycle: acquisition, optimisation, and exit. This should help us get some flesh onto the bones of ‘the digital transformation’ and see what it looks like in everyday investment contexts.

Digital creates value throughout the ownership cycle

The first point at which digital competences are key is acquisition. A lot of family offices and fund managers now understand that buying a fire-sale retail outfit with no online operations and a legacy burden heavy enough to sink a ship today means painful write downs and write offs tomorrow; they understand that they need to even out their portfolios to include companies with digital business models – or at least the potential to build them. So what they need to learn is how to assess potential investments from a digital standpoint, something I refer to as ‘digital due diligence’.

Currently, many investors pour man-hours into tax, commercial, financial, and legal due diligence, picking apart tax calculations, business plans, annual statements, and existing contracts to the nth degree, but neglect to look at even half as much detail at the digital status quo of the potential investment. Even simple questions are not always asked: What is the company’s digital strategy and how plausible is it? What are its existing digital operations and with what kind of technology is it running them? What do its online marketing and sales metrics look like? Does it offer an of-the-moment user experience? Who in the company has real digital expertise?

Not doing digital due diligence can have consequences just as serious as not carrying out a thorough assessment of the contractual domain or balance sheet: ticking digital time bombs such as unrecognised ‘technical debt’ – i.e. the spending that will be required to turn currently functional, but wholly provisional, programming into clean, robust code later down the line – can explode several years later in much the same way as over-generous pension obligations. Issues such as this may, when diagnosed, turn out to be deal-breakers or, at the very least, lead to wholly different valuations. Meanwhile, the absence of a credible digital road-map or of digitally-minded talent in key positions should have an effect on what kind of governance is required after the deal.

That takes us on to the second phase: optimisation. Essentially, active investors can leverage digital potential in portfolio companies by:

- Digitising core processes

- Expanding business digitally

- Creating new digital business models

It is always surprising how many well-established companies – some who are already selling quite successfully online – still do not have fully digitised product data for their whole range or are lacking even basic digital customer records, for example. So just digitising existing processes can offer substantial savings – and open up new possibilities in e-commerce, customer care, etc. This kind of digital business expansion can also be driven by a new approach to digital marketing, for instance, or by improvements to the user experience. The final step in digital optimisation is to develop and implement wholly new digital business models, often following a wholesale restructuring of the company’s technology architecture. By tapping into wholly new business areas, growth goes up significantly – and, with it, the valuation.

Which is where we reach the third point at which family offices and fund managers need digital smarts: exit. Even in existing portfolio companies in which investors did not carry out digital due diligence or oversee any specific digital optimisation, there may be as-yet unrecognised or underemphasised digital KPIs with the potential to act as valuation levers. Some can even be optimised short-term pre-exit to capture immediate value – and tell a convincing story about post-deal potential. In any case, in a marketplace in which buyers are increasingly paying attention to digital, not actively presenting relevant assets at sale would be like neglecting to mention in the prospectus that a property has a garden: buyers looking for a garden will not be inclined to come for a viewing – and those that come and notice the garden are unlikely to point to it and explain why, in their view, the house is actually worth more because of it.

Digital starts at home

Now that we’ve looked at the role of digital competencies mean through the ownership cycle and seen some specific incidences of how they can help identify and create value, it will have become clear that no family office or investment fund will be able to act on any of this without in-house digital expertise. That doesn’t mean that everyone needs to learn how to code and start drinking Club Mate, but it does mean that more than one person in the organisation will have to start thinking about which digital competencies are needed – and looking for the right people to offer them.

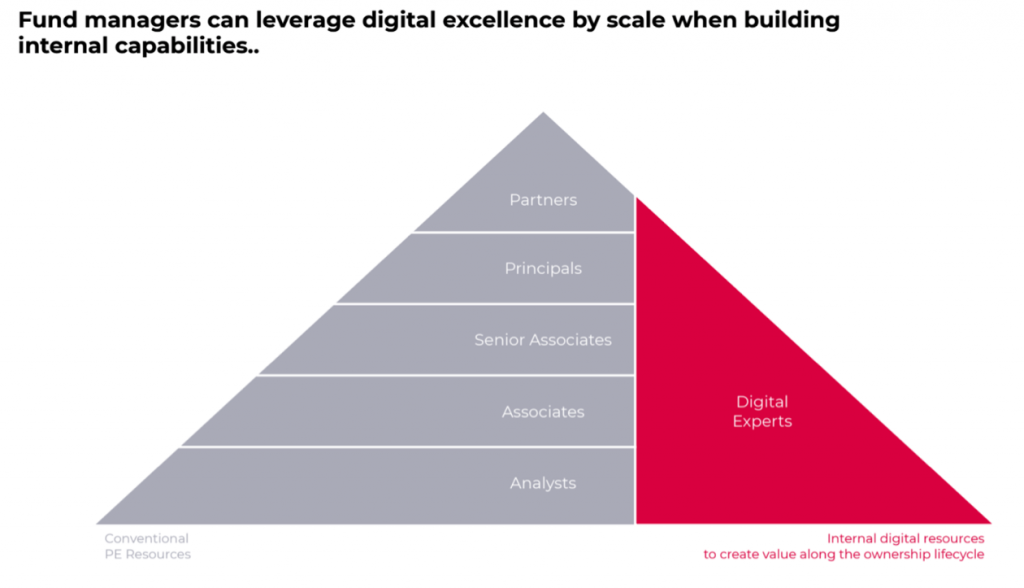

At the beginning, working with external advisors and consultants can be a good way to identify which digital skills are needed where; cooperation with digital experts on a contract basis can be a good stop-gap and provide a learning experience, too. Another key step early on is to network: it is far easier to find and hire digital talent through recommendations than by advertising vacant positions; after all, the people you want aren’t looking for work, but rather being looked for. In the medium term, you’ll be looking to build up your own corps of digital experts, from analyst right up to partner level. At the top, a partner with real digital credentials will help focus and direct your digital efforts while a stable of analysts and interim managers with an understanding of digital will help you anchor it in your acquisition, optimisation, and exit processes. At the end of the day, you won’t be able to reliably leverage digital value without a strong set of in-house digital competencies.

Let me close with some good news: the fact that I felt compelled to write this article means that the overall position of the industry vis-à-vis the digital transformation is weak. And as any good fund manager knows, recognising potential ahead of the market and then acting on it fast is half the battle…