Encouraged by Alexander Graf and his critical analysis of the current digital environment I asked myself why so many irrational business seem to get an almost unlimited amount of funding. In Germany there is always Zalando as a great example of this trend. The business is so far not profitable and investments that by now are topping over a billion Euros will never be recovered but international money is being thrown at Rocket Internet with an ever increasing speed. Its business model is not closely examined and investors push new capital into the firm without even asking some of the most basic due diligence questions. Is it really a plan to buy up the fashion market and pray that your proprietary brands and size will eventually lead you to break even? How are logistics organized behind the shiny technology and TV commercials? Why is there such an irrational rush to throw more money at these kind of businesses? Since we are now starting to talk about investments going into the billions I am going to take a macro economic perspective to create a possible explanation.

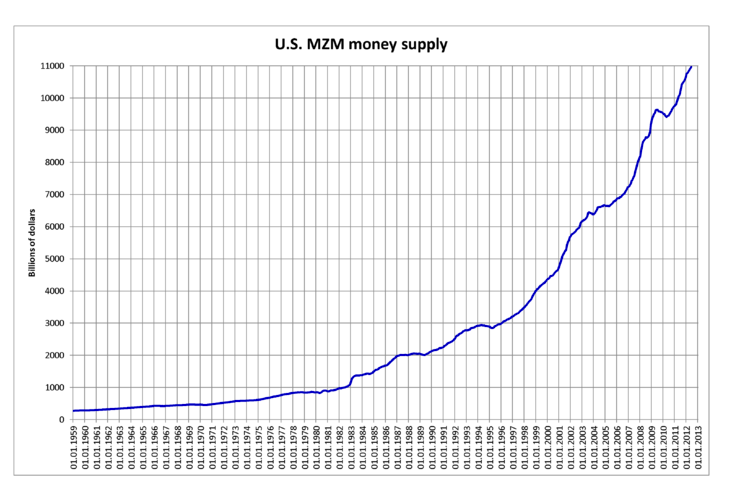

Due to the current monetary crisis money has been pumped into our economic environment – if printing presses would still be responsible for monetary supply we would be running out of ink.

As you can see from the graph above monetary supply has increased substantially. In Europe it is a fairly even growth story but it becomes even more drastic if you look at monetary supply expansion in the United States.

What are investor to do with all this capital that has been pumped into our economy? There is no substantial growth in the „real“ economic output within the developed word – in fact there is a decline based on the recession the European Economic Area and the United States are currently going through. In addition there is only so much capital that can be invested in „traditional“ economies in rapidly growing markets e.g. BRICS countries. On top of these factors investors are also scarred – the ongoing EURO crisis, horribel US economic data, emerging conflicts in the Middle East and Asia … all this has impacted the ability to invest large amounts of capital. Investors now have less opportunities and more importantly have come to terms with lower return expectations, while taking higher risks.

What does this mean for digital investments?

Based on the above described trends we will continue to see irrational capital allocation in digital growth projects such as Zalando. Investors will increasingly accept long-term returns that are barely above inflation just for a chance to allocate some of their access capital. It does not mean that it will become any easier to raise growth capital below EUR50 million but it is becoming easier to collect amounts above EUR250 millions for growth projects.

Entrepreneurs THINK BIG!

So in conclusion tech-savvy entrepreneurs: stop thinking about running a business on EUR10 million start to think how you could allocate EUR500 million!

[…] hat mein Kollege Nils gestern einen interessanten Beitrag gepostet. Er sieht anhand der Geldmengen Entwicklung, gekoppelt mit zunehmend weniger Möglichkeiten […]

You mean the second bubble in digital economy is growing in this time?

The big difference: Now the silly money is entering the market, that in my oppinion these investores, who have many money, but no idea or experience with digital business-models. Yes, indeed to get money mus be a very easy thing now for start-ups. Actually more in the British or US-American area, but soon in Europe too. You see that too in the founding of accelerators and incubators, espeacially in Germany.

I would hope, that „the big liquidity“ now would give to social projects, better: to enterprises, which do any new services and products to help in a social problem (social entrepreneurship). Think, the money there will see much more positive return than in the xxx copy of a digital businessmodel

@Susanne: Indeed social entrepreneurship is a much neglected topic in Europe – in the US the movement to make a profit in order to reinvest in social issues is much more established. I think that awareness and a culture of social engagement is needed PRIOR to funding various ventures. So I do not see a direct impact but hopefully social entrepreneurship will become more common and accepted in Germany/Europe.